Over the course of his entire 20-year professional career, Kobe Bryant earned a total of $323.3 million in NBA salary. That's enough to be the sixth-most money earned from NBA salary behind Kevin Garnet ($334 million), Russell Westbrook ($335 million), Kevin Durant ($349 million) Chris Paul ($359 million) and LeBron James ($431 million). As you know, during his legendary professional career Kobe also earned a fortune off the court from dozens of lucrative endorsement deals. Kobe's most notable endorsements included Nike, Sprite, McDonald's, Turkish Airlines, Lenovo, Hublot and Panini. Kobe's popularity in China enabled him to sign lucrative Chinese-specific endorsement deals with companies including Alibaba, Sina.com and Mercedes Benz. By our count, Kobe Bryant earned $350 million from endorsements during his playing days.

So that's $323 million from salary and $350 million from endorsements, over a 20 year career. Impressive numbers.

What's more impressive?

Thanks to a single deal he struck after taking ONE SIP of a new sports drink, Kobe Bryant's estate wound up making money than he ever earned during his lifetime from either salary or endorsements, respectively…

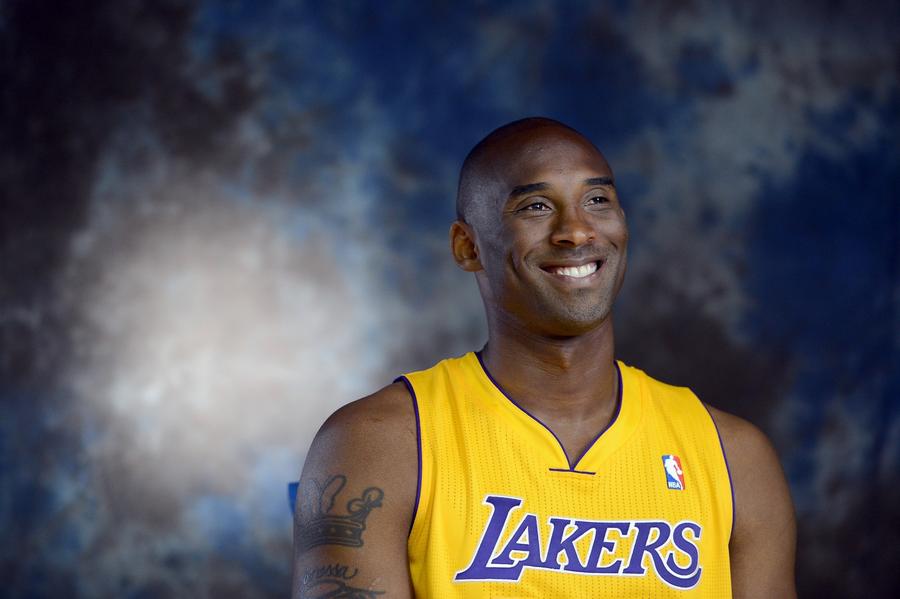

Getty

BodyArmor

Back in March 2014 Kobe decided to invest in the sports beverage company BodyArmor after taking just one sip of the drink. BodyArmor positioned itself as a healthier alternative to Gatorade. None of its products contain artificial sweeteners or colors.

BodyArmor was co-founded by Mike Repole and Lance Collins. Repole's previous company Glaceau, which owned vitiminwater and smartwater (the brand names are intentionally lower-case), was acquired by Coca-Cola in 2007 for $4.1 billion. Collins' previous ventures include Fuze tea.

In the year prior to Kobe's investment, BodyArmor generated $10 million in revenue.

When the details were all worked out, in March 2014 Kobe paid $6 million for a 10% stake in BodyArmor. In other words, when Kobe first invested the company was valued at…

$60 million

Fast forward a few years.

In 2018, BodyArmor generated a little over $250 million in revenue. In August of that year Coca-Cola bought 15% of BodyArmor for $300 million. The valuation Coca-Cola agreed to?

$2 billion

At that point, Kobe's $6 million investment had turned into $200 million on paper.

As part of this transaction, Coca-Cola took over all bottling and distribution of BodyArmor in exchange for an additional 15% equity stake, bringing Coke's ownership to 30%.

BodyArmor generated roughly $1.4 billion in revenue in 2021. For perspective, Gatorade generates around $8.5 billion per year in revenue.

On November 1, 2021, Coca-Cola struck a deal to acquire the remaining 70% of BodyArmor, to take 100% control. Coca-Cola paid $5.6 billion for the 70% stake. This deal valued BodyArmor at…

$8 billion

At some point between the last two Coca-Cola investments, Kobe's equity was reduced from 10% to 5%. It's not known if he cashed out 5% in a previous funding round OR if relinquishing 5% was part of the deal to give Coke an additional 15% for taking over bottling and distribution. Likely the latter.

Therefore, with that November 2021 transaction, Kobe's estate walked away from BodyArmor with a payday of…

$400 million

That's $400 million on a $6 million investment.

(Photo by Harry How/Getty Images)

What Would Kobe Bryant's Net Worth Be Today?

At the time of his death in January 2020, Kobe Bryant's net worth was $600 million. At that point, his BodyArmor stake was valued at $200 million pre-tax. Without BodyArmor his net present value net worth was $400 million.

If Kobe was still alive at the Coca-Cola acquisition and received a $400 million windfall, he would likely have kept around around $270 million after taxes. When added to his $400 million "other" net worth, he would have an after-tax net worth of $670 million.

Read more: How Kobe Bryant Turned One Sip Of A New Drink Into $400 Million

0 Comments